Outlook 2023: Consumer Trends

The third in a series of three forecast articles explores the ways that economic instability and shifting consumer values will impact food and beverage purchase decisions in the year ahead.

Article Content

If you’re looking for the main driving force behind the latest trends in consumer behavior, look no further than that timeworn cliché from the 1990s: “It’s the economy, stupid.”

As global consumers settle into a new normal in the wake of the COVID-19 pandemic, more than two-thirds (67%), on average, say they feel the economy in their country is bad, according to Ipsos Global Advisor polling in 28 countries, and inflation is their top worry among social and political issues. Those worries are not unfounded: During the past 12 months, 62% of global consumers have reported a noticeable rise in the cost of their food and beverages, according to Innova Market Insights.

The current inflationary economy is prompting consumers to reconsider the kind of value they are receiving for their food and beverage dollars in a variety of ways. In fact, “Redefining Value” heads Innova Market Insights’ Top Ten Trends for 2023 report, as consumers adapt to the global cost-of-living crisis in the face of economic and political volatility, says Lu Ann Williams, cofounder and global insights director at Innova.

Higher prices are already impacting U.S. consumer purchasing decisions for food staples, the Rabobank North American Agribusiness Review reported in August, as shoppers switch to cheaper alternatives and seek out deals and discounts. McKinsey & Co.’s latest U.S. Consumer Pulse survey suggests that 74% of consumers are changing their shopping behavior to get more for their money, including buying food in bulk, adjusting the quantities purchased, and opting for a less expensive brand or private label.

Food Technology editors talked to a wide range of food industry market researchers, trendspotters, and strategists to home in on the top five consumer behavior trends that will shape the food and beverage market in 2023 and beyond. Here’s what we found.

1. Rethinking the Value Equation

Cost and value for money have become more important to one in two consumers globally when making food choices, according to Innova research. As a result, shoppers are turning their attention to simple but nutritious goods that are affordable. Key behaviors include buying in bulk, opting for private labels, cooking from scratch, reducing spending on luxury items, and purchasing fewer items, says Williams.

“Consumer interest in affordability has gone up by 70% in the 12 months to July 2022,” says Ranjana Sundaresan, lead research analyst at food and beverage artificial intelligence company Spoonshot. “As part of this, people are trying to make their budgets stretch as much as possible, and this means trading down or cutting back on certain foods. Interest in trading down has seen a steep 163% increase in the 12 months to July 2022 as well.”

But for many consumers, value is also about more than finding the lowest price. Nearly 60% of consumers agree that they’d rather pay more for a higher-quality product than pay less to receive average quality, according to recent Mintel research.

“Assuming we continue to see a slump or recession, the biggest thing [foodservice] consumers will want to see are creative, innovative offerings that are perceived as being a good value,” says Mike Kostyo, trendologist and associate director, content at Datassential. “That doesn’t mean going all in on low prices and combo meals—far from it. Instead, it means to think holistically about what value means in the consumer’s mind.”

Consumers who are cutting back on restaurant meals to save money, for example, may see in-home treats or sophisticated meal solutions from the grocery store as a good value for their food dollars compared with the cost of dining out.

“Inflated prices for both groceries and foodservice favor in-home meals as consumers try to keep their food expenditures in check,” says Darren Seifer, executive director, food and beverage industry analyst at NPD Group. “Even with food-at-home costs rising faster than restaurant costs, an in-home meal is on average about a third of the cost of a restaurant meal. Consumers know this, and the recovery in restaurant traffic slowed in Q2 of this year, especially for lower-income consumers.”

Dining patterns have shifted, and there’s more change ahead, says Joan Driggs, vice president, content and thought leadership at IRI. “An IRI OmniConsumer survey in July 2022 finds that 78% of meals are prepared at home, compared with 48% in 2019,” she notes. “This is a trend that will continue into 2023, but it will look a little different. The scratch cooking of 2020 is giving way to more convenient meals at home. Consumers are increasingly looking for shortcuts, including cooking sauces, marinades, even prepped ingredients. These shortcuts are also an easy way for consumers to experience new cuisines.”

Jenny Zegler, associate director at Mintel Food & Drink, agrees that low prices will not be the only signals of value for many consumers, especially those with disposable income. “Consumers also will be looking for products that deliver value because they meet their personal preferences for essential nutrition, added health benefits, or natural ingredients,” says Zegler. “Indulgent food and drink categories will be sources of value because they are affordable treats that bring much-needed pleasure as we enter yet another year of uncertainty and stress.”

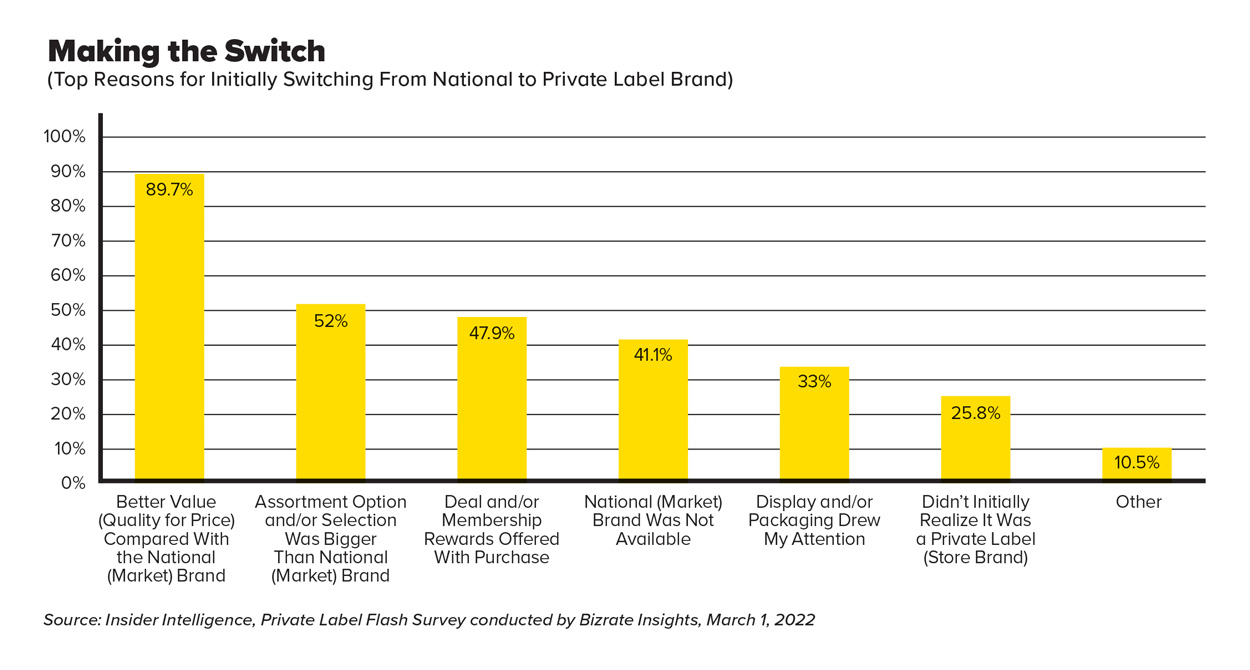

2. Plunging Into Private Label

It’s a new day for private label food and beverage products, with value-driven consumers taking a fresh look at alternatives to pricier name brand items. Sales of store-owned brands jumped 6.5% in the first quarter of 2022, according to market research firm Insider Intelligence, compared with a 5.2% increase in national brand sales, per data from IRI. Insider Intelligence reports that nearly 80% of U.S. adults say they either have purchased or are willing to purchase private label pantry and other products, and more than six in 10 consumers (63%) say brand name is not important to them when shopping most categories, according to new Mintel research.

“With the continuation of economic struggles in the United States and abroad, consumers will consider trading down from their brands to private label—unless brands have made a deep connection with consumers and fit as an important part of their life or lifestyle,” says Dan O’Connell, CEO, FoodMix Marketing Communications.

“With inflation currently at a whopping 8.7% or higher … I foresee consumers ‘downshifting’ all of their food procurement and consumption activities,” adds Liz Moskow, principal at Bread & Circus Future Food Advisory. “On shelf, this looks like a switch from name brand to private store label. Or trial of new products that have promotional pricing rather than staying brand loyal no matter the price or size of the product.”

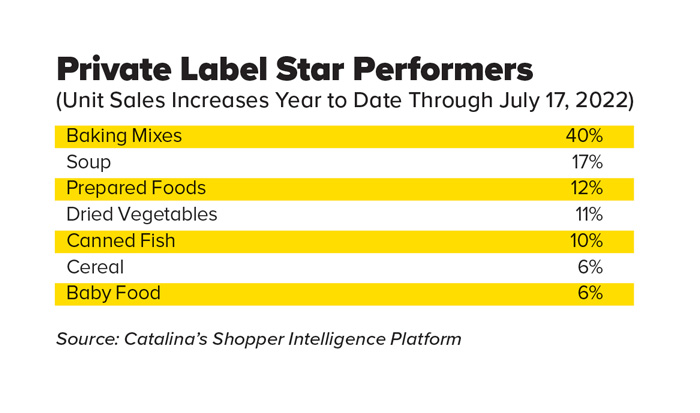

Private label baking mixes, soup, prepared foods, dried vegetables, canned fish, cereal, and baby food are the biggest category winners for the first half of the year, according to Catalina’s Shopper Intelligence Platform. (See figure on this page.) Catalina’s analysis suggests that consumers looking for affordable lunch and dinner solutions are driving higher sales of store brand canned fish and soup, while the 10%–11% hikes in brand name cereal prices reported by the U.S. Department of Agriculture make private label alternatives more attractive.

Major retailers already are losing no time in beefing up their store brand offerings. In September, Kroger announced the launch of Smart Way, a new opening price point product line in the Our Brands portfolio that combines 16 legacy brands into a single, easy-to-find identity. Kroger initially offered 150 Smart Way products and plans to add more items. Target debuted its Favorite Day indulgent store brand line in 2021, joining the retailer’s successful Good & Gather lineup of more than 1,200 items that rolled out in 2019.

3. Consuming Even More Consciously

It’s been well documented that sustainability continues to shine as an important concern for consumers looking to spend their food and beverage dollars with companies they believe in. Sustainability ranks high as a consumer goal in the United States (64%), according to new McKinsey & Co. research, and nearly 50% of global consumers say they have changed their diet in the past two years to lead a more environmentally friendly lifestyle, says Brad Schwan, vice president, marketing at ADM, citing 2022 data from FMCG Gurus market research firm.

Industry observers predict that the desire to eat foods that are positioned as ethically produced will only grow. More than half (54%) of global consumers believe they can make a difference to the world through their purchase decisions, according to 2021 data from Euromonitor, while ADM’s OutsideVoice research found that 73% of global consumers say they feel more positively about companies that are transparent about where and how products were made, raised, or grown.

Among Generation Z and millennials in particular, food and brand choices are important signifiers of lifestyle, beliefs, and values, says Innova’s Williams, and these younger consumers are used to sharing their views openly and widely. She adds that for mainstream consumers, conscious consumption is not a primary purchase driver, but it is a tiebreaker.

“Anyone who has Gen Z family members has probably been lectured about seeing a piece of plastic in the trash instead of the recycling and the animal welfare rating on any meat cooked in the house,” Williams says.

Ben & Jerry’s has announced its mission to make chocolate “100% modern slavery free” by partnering with Dutch chocolate maker Tony’s Chocolonely for a new Chocolatey Love A-Fair ice cream set to launch in January 2023, based on Tony’s milk caramel sea salt bar. The ice cream giant is sourcing cocoa beans for the new product through Tony’s Open Chain, which helps companies take steps to end slavery and child labor in the chocolate industry via a transparent supply chain and fair payment to cocoa growers.

Carbon neutral continues to gain ground as a sustainability claim too, through new offerings like Conagra Brands’ Evol, the first brand to introduce carbon-neutral single-serve frozen meals certified through the Carbonfree Product Certification Program. Five Cheese Alfredo Mac with Chicken is among the eight Evol meals, including three vegetarian offerings, that are produced in a TRUE certified Zero Waste facility.

“We’re seeing millennials and Gen Zers being more and more willing to change their food choices if they can reduce their carbon footprint as long as it’s delicious, interesting, and convenient (and doesn’t mean more complicated cooking at home),” says Arlin Wasserman, founder and managing director of Changing Tastes food strategy consultancy. “Climate change is going to be a big part of their future.”

Suzy Badaracco, president of Culinary Tides forecasting think tank, says younger consumers also tend to believe there is a health benefit to consuming sustainable products, in addition to their desire to influence corporate policy with their purchase choices. In fact, 28% of consumers globally now include “environmental well-being” when thinking about holistic health, according to Innova Market Insights 2021 research.

4. Accepting More Plant-Based Products

According to a McKinsey & Co. report, about 25% of consumers say they ate more plant-based products during the pandemic, and 15% expect to start consuming plant-based products in the next year, joining the 33% who already call themselves consumers of plant-based products. Although sustainability is a factor in opting to eschew meat, most consumers—especially in the United States—eat and drink plant-based products to benefit their own health much more than the health of the environment, McKinsey’s research suggests.

There’s no stunting growth in the $7.4 billion retail market for plant-based foods, up from $6.9 billion in 2020, according to the Good Food Institute. Plant-based food sales grew three times faster than total food sales in 2021 and have rocketed up 54% in the past three years.

As the plant-based market expands, watch for consumers to become more adventurous in their product selections. “No longer merely a mimic, green gastronomy will blossom as a standalone sector in 2023, giving brands significant opportunities to diversify and expand,” predicts Innova Market Insights in its Top Ten Trends for 2023 report.

Two-thirds of respondents to Innova’s global survey expressed a desire to try plant-based versions of traditional, local cuisines, and the industry is responding with a large increase in ready-meal offerings, with lots of opportunity for expansion into meal kits and creative recipe combinations. In September, Impossible Foods unveiled a new lineup of eight single-serve, frozen, plant-based entrées called Impossible Bowls, including Chili Mac with Impossible Pork and Teriyaki Impossible Chicken. Beyond Meat has rolled out new Beyond Steak, frozen, plant-based, seared steak tips that can be prepared in a skillet or air fryer in just five minutes.

“Plant-forward trends will continue to thrive, with markets and brands moving to expand into kids’ foods and snacks such as vegan cheese sticks or plant-based growing up milk,” says Kamesh Ellajosyula, president and chief innovation and quality officer at Olam Food Ingredients. He adds that some brands are also trying to change the perception that plant-based products are pricey by offering cost-accessible products such as vegan fast-food imitations or more sophisticated meal kit options.

5. Choosing Functional Foods for Mental Health

A 2021 global survey by Kerry suggests that more than 40% of consumers have purchased more functional foods and drinks since the start of the COVID-19 pandemic. In addition to seeking immunity support, consumers show a growing interest in addressing mental health issues that have taken their toll in the wake of the pandemic, say industry experts. Nearly half of global consumers say they are more conscious of their mental well-being because of the pandemic, according to 2021 data from FMCG Gurus, and Mintel reports that one-quarter of consumers consume functional foods for their calming/relaxing benefits.

“While health and wellness were prominent before COVID-19, the pandemic further heightened this holistic health trend,” says Amy Marks-McGee, founder of market research firm Trendincite. “To stay healthy, consumers have turned to food and beverage as ‘medicine.’”

ADM’s Schwan has a similar perspective. “We foresee opportunities in the areas of functional and active nutrition, and self-care eating practices to benefit physical, mental, and emotional well-being,” says Schwan. “For instance, 48% of global consumers plan to address their mental wellness over the next year—an issue that ranks just behind immune function, digestive function, and heart health.”

For many, a desire for improved wellness through diet translates into a demand for functional foods that address their specific health concerns. The global functional food and beverage market is projected to grow from $281.1 billion in 2021 to $529.7 billion in 2028 at a compound annual growth rate of 9.5%, according to Fortune Business Insights.

New functional products tapping into the mental health focus include Velty freeze-dried, caffeine-free coffee featuring functional ingredients like lion’s mane and reishi mushrooms for stress reduction and immune support. Nightfood, which bills itself as the “sleep-friendly snack company,” rolled out its new Prime Time Chocolate Chip cookie this summer with ingredients and nutrients that research suggests can support nighttime relaxation and better sleep quality, according to the company’s website.

“We will continue to see functional ingredients with specific benefits touted in product claims, … [and] I think mental health will be the next evolution of functional food, with a focus on mood-enhancing ingredients such as mushrooms and adaptogens,” Marks-McGee predicts.

More Trend Talk From Industry Watchers

“In 2023, consumers will continue to think more critically about the true value of the food and drink they buy.”

—Melanie Bartelme, global food analyst, Mintel

“[Gen Z and young millennial] wellness needs may develop [into] a continued focus on personalized nutrition, coupled with a search for better-for-me quality food and drink offerings and evolving immunity tie-ins.”

—Rob Corliss, chef/founder, ATE culinary consultancy

“The acceleration [in private label growth] is the result of inflation and the lingering effects of the pandemic and will cause a permanent shift for consumers.”

—Louis Biscotti, national food and beverage services leader, Marcum

“We are seeing … a move toward functionality that is more practical and substantiated, as previous trends may have overpromised on delivery (e.g., CBD, turmeric). Nutrient density is likely to revert back to clear benefits (inherent fiber, digestibility of protein grams) to ensure consumers are spending their dollars wisely.”

—Shelley Balanko, senior vice president, The Hartman Group

“The … continued growth of vegan, vegetarian, and flexitarian diets will push for further adoption of plant-based and animal-free products. This major trend is driven by the growing awareness of the environmental impact of the modern food system, coupled with the growing global health awareness.”

—Eyal Afergan, co-founder and CEO, Imagindairy

Key Takeaways

- Inflation and uncertainty about the economy are major drivers of current purchase behavior, leading to increased interest in value for dollar and boosting private label sales.

- Sustainability and other ethical considerations continue to increase in importance for shoppers, especially among younger consumers.

- Health-based concerns underlie growing consumer interest in more sophisticated plant-based foods and beverages and functional products designed to support mental health.

.jpg?mw=500&hash=D1E2E8B94FED0CCA2F5CEA8243FD787B)